March 2023 - Astris Finance Congratulates its Client CVE for the Closing of a EUR 100m Capital Raise

Astris Finance congratulates its client CVE, a French renewable energy independent producer, for the closing of a capital raise whereby Intermediate Capital Group plc (ICG) will invest EUR 100m in CVE to finance their expansion.

This new equity injection will fund CVE's growth in areas such as biogas and agrivoltaics in France as well as solar activities in Chile and the US. More generally it will fund CVE's ambitious development plan, aiming at multiplying by four its installed solar capacity to reach 2.7 GW by 2027 and by 8 its biogas capacity to reach 1.5 TWh by 2030.

Pierre de Froidefond, founder and co-chairman of CVE stated: “Thanks to Astris’ financial advice, this operation was set up in a short time frame. It will allow us to continue our development, in a global economic context where the need for renewables is exploding”.

Arnaud Germain, who heads Astris Finance’s operations in France and Germany, said: “We want to thank CVE and more particularly Pierre de Froidefond, Hervé Lucas and Arnaud Réal del Sarte for their confidence in Astris Finance’s capacity to help them close such an important transaction for their development plan. We are very proud to have successfully advised CVE to design and setup this capital raise with a strong partner such as ICG.”

Astris acted as exclusive financial advisor to CVE. This landmark transaction further demonstrates Astris’s premier position in the European renewable M&A sector, where we are advising on four transactions of similar nature, that are slated to close in the next 3 months.

March 2023 - Astris advises InfraBridge on a c. USD 150 Mn financing of e-buses fleets in Colombia

Bogotá, March 2023 - Astris Finance congratulates its client InfraBridge (previously AMP Capital's global infrastructure equity) for achieving financial close regarding the concessions of Fontibón and Usme (“the Projects”).

The Projects are part of the Transmilenio transit system in Bogotá, consisting in the replacement of 401 buses used for public transportation with new electric buses and the design and construction of the support and ancillary infrastructure (warehouses, chargers, etc.) under a 15-y concession agreement. Our client, InfraBridge, acquired an 80% participation in these concessions from Italian developer Enel X; the e-buses were provided by tier-1 Chinese automotive producer BYD and are being operated by local company Transvial.

The c. USD 140 Mn dual-currency facilities were provided by BNP Paribas and IDB Invest (including a UK-SIP tranche) under the sustainable loan framework, together with c. USD 11 Mn DSRF provided by BNP Paribas as sole issuing bank.

The acquisition and financing of the Projects comes right after DigitalBridge Group acquired AMP Capital’s global infrastructure equity investment management business.

“We are particularly happy to celebrate our first successful transaction with InfraBridge for a very promising sector. It makes it even better when we participate in projects that have an instant and direct positive effect in the everyday life of Colombians.” stated Santiago Pardo, Head of Astris Finance in Colombia.

“We are delighted to have advised InfraBridge in this landmark financing in Colombia under a sustainable loan framework. This double financial close of dual-currency financing is the perfect illustration of what Astris Finance does: full commitment to structure around the challenges our clients face and creativity to work with the widest array of financing sources possible.” stated Damien Dupa, Associate Director at Astris Finance.

Astris acted as exclusive financial advisor in both stand-alone financings and assisted InfraBridge in the buy-side process. These transactions represent Astris’s first participation in the e-mobility sector and further demonstrate Astris’ premier position in the Colombian renewable energy and infrastructure advisory market, where we are currently advising on six transactions across a variety of sectors.

January 2023 - Astris Finance advises Ecopetrol S.A. in connection with the approximately 100MW IGA Solar PV project in Colombia

Bogotá, January 2023 – Astris Finance advises Ecopetrol S.A. in connection with its recently announced partnership with Total Eren to develop, finance, construct and operate an approximately 100MW Solar PV project in Colombia

Astris Finance congratulates its client Ecopetrol S.A. (“Ecopetrol”), the largest company in Colombia and one of the most important diversified energy companies in the Americas on the recently announced signing of a binding agreement to develop, finance, construct and operate the approximately 100MW IGA Solar PV project in Colombia (the “Project”) with Total Eren, a leading global renewable energy IPP.

The Project will be built in the Rubiales oil field, owned by Ecopetrol and one of the most important fields in the Colombian hydrocarbons industry, located in the municipality of Puerto Gaitán, Meta. Ecopetrol will be using the electricity generated by the Project to provide power to the Rubiales oil field under a 17-year PPA, replacing other sources of energy.

Ecopetrol selected Total Eren to develop, finance, construct and operate the IGA Project after a competitive process. Total Eren will have a 51% share in the IGA Project and Ecopetrol will own the remaining 49%. Construction is expected to begin during the first quarter of 2023, with operation of the plant scheduled to begin one year later.

Astris acted as exclusive financial advisor to Ecopetrol and assisted in the structuring of the Project as well as in the design and execution of the competitive selection process for the partner. The transaction, which was recently signed in January 2023, also represents a major investment for Total Eren in the renewable energy sector in Colombia.

“We are very pleased to have advised Ecopetrol in connection with this partnership. The transaction represents the first direct investment for Ecopetrol in the solar PV sector and is a very important step in the execution of its long-term renewable energy strategy. We congratulate both Ecopetrol and Total Eren and wish them success in their partnership”, said Santiago Pardo, Head of Astris Finance in Colombia.

This landmark transaction further demonstrates Astris’ premier position in the Colombian renewable energy and infrastructure advisory market, where we are currently advising on several transactions across a variety of sectors.

December 2022 - Astris Finance congratulates its client Altano Energy on the successful financing of a 107.6MW solar and hydro portfolio in Spain

We are pleased to announce the closing of the Nimbus financing where Astris advised Altano Energy, the renewables investment platform backed by UK firm Pioneer Point Partners, in relation to the total financing of an installed hybrid capacity of 107.6 MW, comprising 11 operating hydro plants and a solar PV plant to be operational by 2024.

The project revenues will benefit from a long-term PPA for the entire portfolio, taking advantage of the complementary mix of technologies and geographical diversification.

This unique and innovative financing brings several important benefits for Altano Energy in terms of structure, leverage and cash flow stability for the shareholder. The transaction was arranged and financed by Santander Corporate & Investment Banking, which provided the +90M€ senior financing facilities.

Astris Finance acted as exclusive financial advisor to Altano Energy.

December 2022 - Astris Finance Congratulates its Clients Cymi and Brookfield on the Successful Closing of two Transmission Lines in Brazil for an Aggregate Amount of c. BRL 1.7bn

December 2022 – Astris Finance is pleased to announce the successful financial close in connection with Dunas Transmissão de Energia S.A. (“Dunas”), a 408 km transmission line project located in the northeast of Brazil, and Pampa Transmissão de Energia S.A. (“Pampa”), also a transmission line project - 326 km long - located in the south of Brazil.

The financing package for Dunas totaled BRL 920m (c. USD 184m) and it is comprised of BNB and BNDES, which for the first time in the transmission line sector will share project collateral. Both sources funded their first disbursements in Q3 2022.

Pampa, on the other hand, obtained a total financing package of BRL 742m (c. USD 148m) from BNDES that provided financing through a combination of an innovative infrastructure debentures structure and a backstop facility.

Dunas is fully controlled by Cymi Construções e Participações S.A. (“Cymi”), a subsidiary of the French group Vinci S.A., while Pampa is owned both by Cymi and by Brasil Energia Fundo de Investimento em Participações Multiestratégia, a subsidiary of Brookfield Asset Management.

Astris acted as exclusive financial advisor in both projects, supporting the sponsors during the entire financing negotiation and structuring process, through first disbursement.

Astris has a long track record in the transmission sector in Brazil, where we have advised clients across M&A, bid stage, financing and refinancing transactions. In the last 5 years, Astris successfully structured and closed more than BRL 10 billion (c. USD 2 billion) in financings in the Brazilian transmission line sector alone.

December 2022 - Astris Finance Congratulates its Client JERA Co., Inc. on the Successful Acquisition of a 35.1% Stake in Gia Lai Electricity Joint Stock Company

Astris as financial advisor to JERA Co. Inc. (“JERA”), Japan’s largest power generation company, in relation to its acquisition of a 35.1% stake in Gia Lai Electricity JSC (“GEC”, HOSE:GEG), the energy development arm of prominent Vietnamese conglomerate TTC Group. JERA acquired the stake via a full buy-out of the GEC shares previously held by International Finance Corporation (“IFC”) and AVH Pte. Ltd (“AVH”), the investment vehicle of Armstrong S.E. Asia Clean Energy Fund Pte. Ltd. The transaction cleared local regulatory approvals and reached closing in December 2022. For this mandate, Astris teamed up with Viet Capital Securities JSC, Vietnam’s leading independent investment banking firm.

GEC’s platform consists of a mix of run-of-the-river hydro, solar, and wind assets in various stages of development and operation:

500+ MW operational capacity, including ca. 300 MW solar assets and ca. 150 MW wind assets; and

1.5+ GW of development pipeline comprised largely of utility-scale wind and solar plants, as well as rooftop solar systems.

As Japan’s largest power generation company, JERA boasts ca. 77 GW of domestic and overseas power generation capacity (including projects under construction), responsible for approximately a third of the total nationwide power generation in Japan.

JERA’s corporate vision for 2035 is “to scale up its clean energy platform of renewables and low greenhouse gas thermal power, sparking sustainable development in Asia and around the world.” GEC’s portfolio is expected to contribute meaningfully to this goal and aid with JERA’s targeted expansion in Vietnam as a priority market. To this end, JERA also announced in March2022 the start of the full-scale operation of its Vietnam subsidiary, JERA Energy Vietnam Co., Ltd., to serve as its base for operations in the country.

In a press release regarding the transaction, JERA Asia CEO Toshiro Kudama said, “Since our investment in Phu My 2.2 in 2005, we have viewed Vietnam as an important market in ASEAN and have sought opportunities to strengthen ties between our two countries. As one of Japan’s leading energy companies, our objectives are to contribute to both economic growth and decarbonization across Asia, and this investment represents another milestone in this effort. As a shareholder in GEC, we will support GEC’s expansion of renewables in Vietnam.”

Hugo Virag, Co-Head of Astris Finance’s operations in Southeast Asia, said: “We thank the JERA Tokyo and JERA Singapore teams for their confidence in Astris Finance’s capacity to help JERA complete its first investment in the Vietnamese renewable energy market. We are very pleased with the outcome of this intense M&A process leading to the closing of a rare and complex acquisition by a foreign investor on the Ho Chi Minh City stock exchange. We are hopeful that this transaction has brought about a well-balanced joint-venture between JERA and the controlling shareholder TTC Group.”

Fabrice Henry, CEO of Astris Finance, added: “At the COP27 meeting in November 2022, Vietnam reaffirmed its ambition to be at the forefront of energy transition. Under the latest draft of the country’s energy sector development plan (known as the PDP8), the country is looking to boost its installed renewable energy capacity from [16] GW currently to [30] GW by 2030. This will require the mobilization of significant capital and the injection of cutting-edge technology, notably to accelerate offshore wind development. We expect the TTC-JERA joint venture in GEC to play an instrumental role in this plan, and to be of strong mutual benefit to the two partners.

This is the fourteenth M&A transaction closed by Astris in the global renewable space in the past twelve months, and the third in Southeast Asia in the past 18 months.

December 2022 - Astris advises Vauban in connection with the acquisition of a portfolio of 3 windfarms totaling 170MW located across the Nordics

Astris Finance congratulates its client Vauban Infrastructure Partners (“Vauban”), a leading European infrastructure & energy investment fund, on the acquisition of 100% of Nordic Renewable Power Holding (“NRPH AB”) from Green Investment Group.

NRPH AB is a portfolio of three windfarms located across the Nordics. The three windfarms, totaling 40 wind turbines for an aggregated capacity of c. 170MW, are fully operational and contribute to provide sustainable energy solutions to local communities and industrial players in the region.

The portfolio is backed by a solid contractual framework with long term operating contracts with leading players and long term offtake agreements with high creditworthiness counterparties.

Astris acted as exclusive financial advisor, supporting Vauban from the binding offer of the transaction until first disbursement.

This landmark transaction further demonstrates Astris’ premier position in the European renewable energy advisory market, where we are currently advising across 8 different countries.

December 2022 - Astris advises VINCI in connection with the acquisition of a majority stake in Entrevias road concession in Brazil

São Paulo, December 2022 – Astris advises VINCI Concessions SAS in connection with the acquisition of a majority stake in Entrevias road concession in Brazil

Astris Finance congratulates its client VINCI Concessions SAS (“VINCI”), a leading global long term infrastructure investor, on the acquisition of 55% stake in Entrevias, a brownfield road concession located in the state of São Paulo, Brazil from the previous controlling shareholder, Patria.

The transaction, which was signed on December 1, marks the debut of VINCI in the road sector in Brazil. Patria will retain a 45% stake in the asset.

The Entrevias road concession is 570km long and crosses São Paulo State from north to south; there were around 30 million transactions in 2021.

”We are very pleased to have advised VINCI in connection with this partnership. The transaction is a milestone for VINCI in the Brazilian road sector and establishes a platform which will allow our client to further expand its business in Brazil.” said Daniel Uzueli, Astris’s Head of Brazil.

Astris acted as exclusive financial advisor to Vinci. Astris has a long-standing global relationship with Vinci: in the past 10 years, we have advised Vinci and its affiliates on as many transactions across the Americas, Europe and Southeast Asia.

This landmark transaction further demonstrates Astris’ premier position in the Brazilian infrastructure and energy advisory market, where we are currently advising on seven transactions across a variety of sectors.

October 2022 - Astris Finance congratulates its client Amarenco on the successful financing of a 80MW solar PV portfolio in Spain

We are pleased to announce the closing of Project Guadiana in which Astris assisted Amarenco, a leading, Irish-based Solar IPP, in the financing of a portfolio of solar assets.

The transaction includes the refinancing of a 49MW project that has been operating since March 2021 and the financing of two greenfield solar projects, with an aggregate installed capacity of 80MWp. Signing of the financing facilities occurred in June and this month the last project of the portfolio reached financial close which enables Amarenco to fully utilize the 45M€ senior financing facilities.

In addition to the senior facilities, Astris assisted Amarenco to recycle the bridge loan that was raised to finance construction into a mezzanine facility, leading to a total debt package of 82M€. The projects will benefit from a short-term PPA.

The Guadiana transaction is part of a pipeline of Solar PV ground-mounted assets that Amarenco is currently developing in Spain.

The new financing brings several important benefits to Amarenco in terms of structure, leverage, and cash flow stability for the shareholder. The senior financing facilities have been provided by Rabobank, Unicredit and ING.

Astris Finance acted as exclusive financial advisor to Amarenco.

October 2022 - Astris Finance congratulates Sonnedix on the successful acquisition of ARCO, one of the largest independent renewable power producers in Chile.

Astris Finance congratulates its client Sonnedix on the successful acquisition of 100% of ARCO, one of the largest independent renewable power producers in Chile. Astris acted as exclusive buy-side financial advisor to Sonnedix in the transaction.

Arco is a large solar and wind generation platform in Chile consisting of 290MW of operational capacity and 200+ MW under development, previously owned by Arroyo Investors. The assets are geographically diversified across the country and include both utility scale and small-and-medium sized generation facilities (known in Chile as “PMGDs”). While Sonnedix has been active in the solar PV space in Chile since 2015, the ARCO investment represents Sonnedix’s first foray into the Chilean wind sector. In combination with Sonnedix’s existing assets, the portfolio will grow the company’s local Chilean presence to over 1GW of total capacity, and 7.4 GW globally.

Tobey Collins, Head of Astris Americas, commented “We are delighted to have advised Sonnedix in this landmark purchase in Chile. After several collaborations in Europe, we are particularly happy to celebrate our first successful transaction with Sonnedix in the Americas region."

Astris Finance acted as financial advisor to Sonnedix on the acquisition -- the second successful M&A buyside closing in Latin America for Astris over last year, following advising the Celeo Group on the acquisition of Colbún Transmisión in 2021. This transaction further strengthens Astris position as the leading financial advisor in the Latin American renewable space where we have closed 15 transactions in the past 5 years for an installed capacity in excess of 2GW.

October 2022 – Astris Finance Congratulates Q-Energy for the Successful Debt Closing of EUR 96m for a 113MWp (87 MWac) Solar PV Project Located in Poland

The solar PV plant will be located in Milkowice, Poland, with a total installed capacity of 113MWp (87 MWac). It is the first project that Q-Energy builds in Poland and one of the largest solar PV plants in Poland to date.

The transaction is a pathfinder in the Polish renewable space, with a Euro-denominated PPA and a Euro-denominated financing. The € 96 m term facility was provided by PKO BP as sole lender.

The Project is currently being constructed and completion is expected to be achieved in December 2024. The energy generated by the solar farm will be sold to Amazon under a long-term, corporate power purchase agreement (CPPA). Amazon is the world's largest corporate purchaser of renewable energy and this CPPA will help Amazon on its path to power its operations with 100% renewable energy by 2025, five years ahead of its original target of 2030.

Astris acted as exclusive financial advisor to Q-Energy in the structuring and closing of the transaction. Since 2018, Astris has developed a significant expertise in the Polish renewable energy sector: we have closed 7 debt financing and M&A transactions in this market for an aggregate value of close to € 1 bn, and our teams are currently managing 3 active processes.

October 2022 - Astris advises DIF Capital Partners for the closing of a partnership agreement with the leading global renewable energy platform Qair

Astris Finance congratulates its client DIF Capital Partners (“DIF”), a leading global independent investment manager, for the closing of a partnership agreement whereby DIF will invest in Qair, a fast growing renewable energy platform company, to accelerate its growth and portfolio build out.

The transaction, which closed in September 2022, took the form of a minority investment by DIF, through DIF Infrastructure VII, in the platform owning the assets.

The platform is focused on a wide range of technologies including onshore as well as offshore wind, utility scale solar, energy from waste, hydroelectricity, storage, hydrogen production, as well as tidal energy. The operational portfolio of ca.1 GW is mainly comprised of onshore wind for c. 75% and solar projects, and the development pipeline capacity amounts to up to 25 GW.

Astris acted as exclusive financial advisor to DIF. Astris has a long-standing relationship with DIF, for which it has acted as exclusive advisor on several M&A and senior debt financing transactions over the past few years.

This landmark transaction strengthens Astris’s position in the European renewable sector, where we have executed 12 transactions since January 2022 (out of which 7 in the M&A space) and are currently managing several processes in France, Spain, Italy and Germany.

September 2022 - Astris Finance congratulates its client Equitix for the successful refinancing of the Grünwald geothermal plant in Germany.

Following the acquisition of the Geothermische Kraftwerksgesellschaft Traunreut mbH (“GKT”) from Grünwald Equity in Q1 2022, Equitix has now reached financial close on the refinancing. Astris acted as exclusive financial advisor to Equitix on both processes.

GKT is a geothermal combined heat and power generation facility connected to a district heating network in Bavaria, Southern Germany. The plant was commissioned in 2014 and currently has 42 years of remaining operating life, its primary objective being the production of electricity and heat from thermal brine energy. The facility has an electricity generation capacity of 5.5 Mwel, with an expected yearly production of c. 34 GWh, and a heat generation capacity of 12 MWth, with an expected yearly production of c. 43 GWh. The project will help avoid c. 20kt of CO2 emissions per year.

”We are very pleased we advised Equitix in connection with the refinancing of this combined heat and power geothermal plant in Germany. The transaction shows the attractiveness of refinancings for operational assets benefitting from a strong feed-in-tariff framework.” said Theoharis Saroglou, Director of Astris's Hamburg office.

This is the third successful closing for Astris Germany in 12 months. Currently Astris Germany is advising clients both on the financing of large-scale greenfield projects and on renewable energy M&A processes.

September 2022 – Astris Finance Congratulates its Client Fotowatio Renewable Ventures (FRV) on the Successful Greenfield Financing of a 123MW Solar Portfolio in Spain

September 2022 – We are pleased to announce the closing of the Carmonita Norte Cluster financing in which Astris advised FRV, a leading Spanish developer with a significant footprint in the global renewable space, in connection with the financing of a 123MW solar portfolio composed of 3 green field projects located in Spain.

Once the plants are operational, project revenues will benefit from a long-term PPA. This portfolio is part of a larger set of Solar PV ground-mounted assets, currently at financing stage.

This new financing brings several important benefits for FRV in terms of structure, leverage, and stability of cash flow to shareholders. The transaction was arranged and financed by ING, MUFG and Santander Corporate & Investment Banking which provided the +80M€ senior financing facilities.

Astris Finance acted as exclusive financial advisor to FRV.

September 2022 – Astris Finance acted as exclusive financial advisor to The Blue Circle in connection with its latest capital raise leading to a strategic partnership with ACCIONA Energía.

Astris Finance is very pleased to announce the successful closing of the third round of capital raise of The Blue CIrcle, a leading Singapore-based developer of wind projects in Southeast Asia. The transaction includes a US$34 million equity investment by Acciona Energia in The Blue Circle and a commitment up to US$113.5 million to provide equity for projects that reach ready-to-build status.

The Blue Circle has 84MW of operating wind projects in Vietnam –in which it maintains a 50% voting stake–, and a 1.4GW+ pipeline of projects at an advanced stage of development. The total portfolio under development amounts to 3.8GW spread across Vietnam, Thailand, the Philippines, Cambodia, Indonesia, Laos and Sri Lanka.

Astris Finance acted as exclusive sell-side financial advisor to The Blue Circle with the mandate to raise adequate capital to sustain the platform’s expected growth over the next five years while minimizing the dilutive impact on the controlling shareholder’s stake in The Blue Circle.

Olivier Duguet, CEO and Chairman of The Blue Circle commented: “We mandated Astris Finance with very specific conditions in terms of partner profile, expected valuation and governance structure, not to mention a “not-to-be missed” long-stop date for completion. Astris entirely managed the process leading to this new partnership with Acciona Energia which is fully aligned with our requirements. I am very thankful for Astris’s commitment, creativity and professionalism in executing this transaction in a timely fashion at this pivotal moment of The Blue Circle’s development.”

Hugo Virag, who heads Astris Finance’s operations in Southeast Asia, said: “We thank Olivier Duguet and The Blue Circle’s shareholders for their renewed confidence in Astris Finance’s capacity to help The Blue Circle raise fresh capital since its very first steps in Southeast Asia, beginning with the long-term, non-recourse project financing of its landmark Dam Nai wind farm in Vietnam back in 2017. We are very pleased with the outcome of this intense six-month competitive process leading to the closing of a well-balanced joint-venture between The Blue Circle and Acciona Energia complemented by an innovative, non-dilutive funding structure.”

Fabrice Henry, CEO of Astris Finance, added: “There is no doubt that the Southeast Asian renewables market is poised for a strong acceleration in the next couple of years, with the upcoming Thai wind program, the launch of a new series of auctions in the Philippines, and the advent of an ambitious PDP8 in Vietnam in particular. In this context, we believe that the partnership we helped establish between The Blue Circle, a regional pioneer, and Acciona, a global renewable powerhouse, will play an instrumental role in helping the region reduce its dependency on fossil fuels.”

This is the tenth M&A transaction closed by Astris this year in the global renewable space, and the third in Southeast Asia in the past 12 months.

June 2022 – Astris #1 in the 2021 IJ Global League Table for European Renewable Energy Financial Advisory

Here is a piece of good news, just before the first semester of 2022 ends: we are delighted to report that -- for the first time since its creation over twenty years ago -- Astris reached the top spot in the 2021 IJ Global League Table for European Renewable Energy financial advisory.

This top position rewards an exciting year 2021 for Astris in Europe where we helped bring eighteen transactions to closing in France, Spain, Germany, Poland and Italy. These include a wide array of deals, both on the financing side (development stage advisory, debt and equity raising) with EUR 3bn raised, and on the M&A side (sell-side, buy-side, investor solutions).

Since 2011, Astris has built an unparalleled track record in the European market from its offices in Paris (2011), Madrid (2017) and Hamburg (2020): in the past 5 years, we have closed over 40 M&A transactions for a combined enterprise value of 10+ bn€ and 50 financing transactions with 9+ bn€ of debt raised.

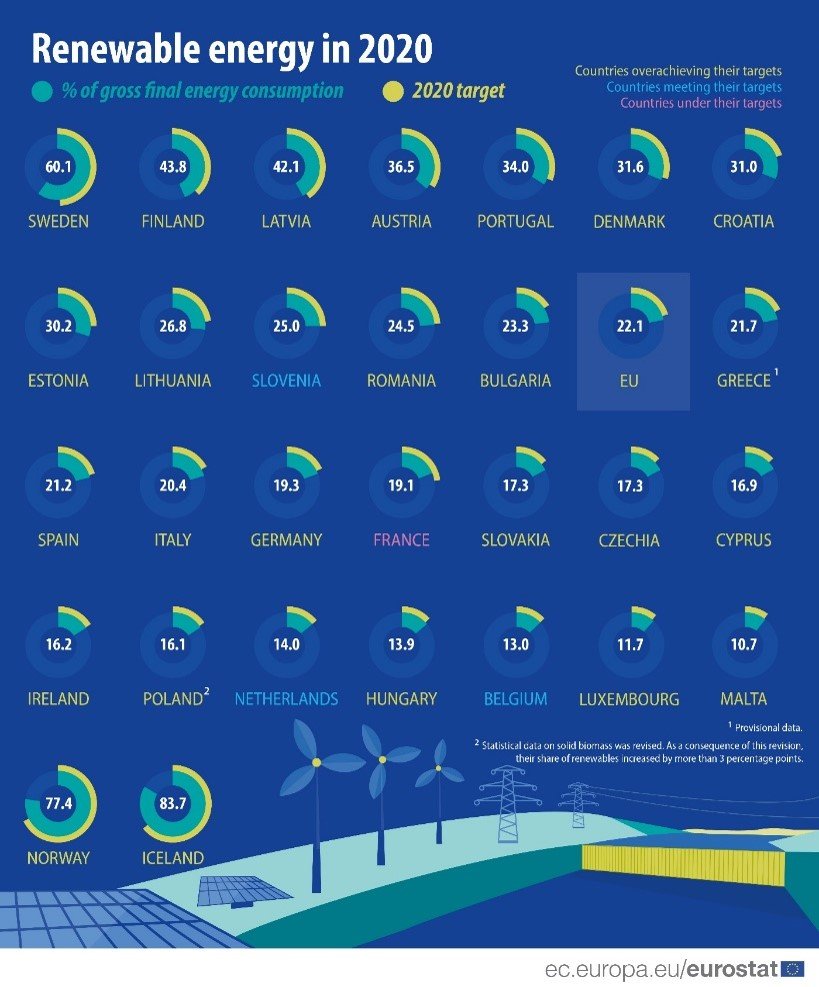

The coming years will be fascinating when it comes to the European renewable energy sector. The “RE Power EU plan” published by the European Commission in May 2022 establishes a three-pronged strategy to drastically reduce Europe’s dependence on Russian fossil fuels: energy savings, acceleration of renewable energy deployment, and diversification of energy sources. Under the second pillar, the Commission increased the target share of gross final energy consumption from renewable sources to 45% by 2030 from just 22% in 2021.

This very ambitious growth will require reaching an aggregate renewable energy generation capacity of 1236 GW by 2030 – an increase of more than 700 GW compared with the installed capacity at the end of 2020. That is fully 100 GW per year! (Source: EU Commission, Eurostat, 2022)

This increased installed capacity will need to come hand in hand with new business models and technologies such as storage, smart grid, peak shaving and demand-side management, EV charging, hydrogen storage, etc. Astris hopes to do its share, however modest, to help achieve this existential challenge!

Thomas Innocenzi, Head of European Operations for Astris said: “As we continue strengthening our position in the European renewable energy space, we would like once again to thank all of our clients and partners for the solid relationships we have established over the years as well as our team for the rigor, creativity and energy deployed on every one of our mandates.”

June 2022 - Astris congratulates its clients for the closing of a USD 475m financing package for the Ferrocarril Central Rail Track PPP Project in Uruguay.

Astris Finance is pleased to announce the closing of a USD 475m financing transaction for the Ferrocarril Central Rail Track PPP Project (the “Project”) sponsored by Sacyr Concesiones, NGE Concessions, Saceem and Berkes (the “Sponsors”).

Following up on Astris’ role as exclusive financial advisor for the USD 860m senior debt package in October 2019 and the USD 75m mezzanine debt in June 2020, Astris advised the Sponsors in (a) structuring and placing a financing package to fund new investments and replace a piece of the initial financing; and (b) extending the maturity and reprofiling part of the existing senior debt (together, the “Refinancing”).

The Project consists of the design, construction, financing, rehabilitation, and maintenance of a 273 km railroad between the cities of Montevideo and Paso de los Toros, Uruguay, under a 19.25-year PPP contract. Construction works are progressing, and COD is expected to take place in H1 2023.

The Refinancing package consists of:

1. The structuring and issuance of a USD 250m private placement subscribed by Allianz GI under a B Bond facility to support the construction of the Project and refinance a portion of the initial financing;

2. The refinancing of USD 175m of IDB and IDB Invest Loans to extend the maturity of existing facilities and match the B Bond repayment profile;

3. The refinancing of a USD 50m B loan provided by Intesa San Paolo.

With this Refinancing, Allianz GI joins the IDB, the IDB Invest, SMBC, Intesa, CAF, CAF-AM and GIP to provide more than USD 1bn of multi-tranche financing to the Project in aggregate.

May 2022 – Astris Finance Congratulates its Client Puerto Bahia Colombia de Uraba (PBCU) on the Successful Closing of a USD 765 Million Port Project in Colombia

Astris Finance is delighted to announce the closing, first disbursment and start of construction for the emblematic Puerto Antioquia project, a US $765 million port complex, for which the first stone was laid on April 23 in Uraba, Colombia. Since 2015, Astris has advised PBCU, the project company, as well as its Sponsors, supporting the entire development of the project, coordinating the contractual and financial equity structuring and raising fully non-recourse senior and mezzanine project financing as well as third party equity.

The Sponsor group includes PiO S.A.S., the initial project developer; CI Uniban, CI Tropical, CI Banafrut, Grupo Santamaria, four of the largest tropical fruit cooperatives in the region, who will be port users; CMA CGM, one of the world's leading shipping lines, who will act as port operator; Groupe Eiffage and Termotecnica Coindustrial, who joined forces to act as EPC contractor; and UPLI, an infrastructure fund managed by SURA and Credicorp.

On the financing front, Astris raised a total of USD 523.7 million of project finance debt made up of two tranches:

US $393.7 million of senior debt from IDB Invest, FDN, Davivienda and Bancoldex; and

US $130.0 million of mezzanine debt from Global Infrastructure Partners.

The project consists of a multipurpose port in the Gulf of Uraba, located in the Department of Antioquia, Colombia. The complex will feature a 38-hectare onshore facility connected to an offshore docking platform by a 3.8-km viaduct. In its first phase of construction, it is designed to accommodate an annual throughput of 660,000 TEUs, 1.5 million tons of dry bulk, 1.1 million tons of general cargo, and 60,000 vehicles.

As the first major greenfield port to be built in the Uraba region, Puerto Antioquia is poised to transform the logistics landscape of northern Colombia and enhance the competitiveness of the Colombian industry. The project will also contribute to the economic and social development of the Uraba region by bringing employment and responsible investment, compliant with the highest environmental and social standards.

Operations are scheduled to start in 2025: when Puerto Antioquia opens for business, it will be the port on the Atlantic closest to a perimeter representing 75% of the country's GDP and connected to the region of Medellin by world-class road infrastructure following the completion of the Mar 1 and Mar 2 4G toll road projects.

Astris Finance is proud to have led the structuring of one of our most exciting and challenging transactions in our 22 years of existence so far. It is an honor to participate in a project that is certain to have a lasting economic and social impact on the beautiful region of Uraba. We are very grateful for the active participation of the most important stakeholders in the region: the local communities around the project, the banana farming cooperatives, the municipal governments of Apartado and Turbo, the department of Antioquia, as well as the various central government line ministries and agencies. We wish the project and its stakeholders a very bright future.

May 2022 - Astris Finance advises on partnership for 400 MW+ ready-to-build solar portfolio in Spain and Italy.

The recent acceleration of government deployment targets for renewable projects in Europe, boosted by the current geopolitical situation of the continent, is leading to an increasing number of transactions whereby local developers syndicate their equity interest in their development portfolio to financial or strategic investors, typically at Ready-to-Build (RtB) stage.

The Spanish market is particularly well suited for this type of partnerships given the strong local hurdles that must be overcome to bring projects to RtB, notably in terms of access to the grid. In this specific transaction, Astris advised the developer in the structuring and placement of an efficient co-investment by a financial investor to recycle the client’s development equity investment in a 400+ MW pipeline located in Spain and Italy -- allowing our client to accelerate the growth of their development pipeline.

Gonzalo Ruiz de Angulo, Head of Astris Finance for Spain, Portugal and Poland, said: “We are very pleased we were able to structure the right partnership and source the right partner for our client. The partner brings competitive long-term capital and in exchange gets access to a quality pipeline of RtB projects. This transaction confirms that the RtB stage is a nice meeting point for developers and investors in terms of risk-return combination in the Southern Europe renewable sector.”

Astris Finance acted as exclusive sell-side financial advisor on the transaction. This is the seventh European renewable partnership on which Astris advised on the sell side in the past 24 months.