São Paulo, December 2022 – Astris advises VINCI Concessions SAS in connection with the acquisition of a majority stake in Entrevias road concession in Brazil

Astris Finance congratulates its client VINCI Concessions SAS (“VINCI”), a leading global long term infrastructure investor, on the acquisition of 55% stake in Entrevias, a brownfield road concession located in the state of São Paulo, Brazil from the previous controlling shareholder, Patria.

The transaction, which was signed on December 1, marks the debut of VINCI in the road sector in Brazil. Patria will retain a 45% stake in the asset.

The Entrevias road concession is 570km long and crosses São Paulo State from north to south; there were around 30 million transactions in 2021.

”We are very pleased to have advised VINCI in connection with this partnership. The transaction is a milestone for VINCI in the Brazilian road sector and establishes a platform which will allow our client to further expand its business in Brazil.” said Daniel Uzueli, Astris’s Head of Brazil.

Astris acted as exclusive financial advisor to Vinci. Astris has a long-standing global relationship with Vinci: in the past 10 years, we have advised Vinci and its affiliates on as many transactions across the Americas, Europe and Southeast Asia.

This landmark transaction further demonstrates Astris’ premier position in the Brazilian infrastructure and energy advisory market, where we are currently advising on seven transactions across a variety of sectors.

October 2022 - Astris Finance congratulates its client Amarenco on the successful financing of a 80MW solar PV portfolio in Spain

We are pleased to announce the closing of Project Guadiana in which Astris assisted Amarenco, a leading, Irish-based Solar IPP, in the financing of a portfolio of solar assets.

The transaction includes the refinancing of a 49MW project that has been operating since March 2021 and the financing of two greenfield solar projects, with an aggregate installed capacity of 80MWp. Signing of the financing facilities occurred in June and this month the last project of the portfolio reached financial close which enables Amarenco to fully utilize the 45M€ senior financing facilities.

In addition to the senior facilities, Astris assisted Amarenco to recycle the bridge loan that was raised to finance construction into a mezzanine facility, leading to a total debt package of 82M€. The projects will benefit from a short-term PPA.

The Guadiana transaction is part of a pipeline of Solar PV ground-mounted assets that Amarenco is currently developing in Spain.

The new financing brings several important benefits to Amarenco in terms of structure, leverage, and cash flow stability for the shareholder. The senior financing facilities have been provided by Rabobank, Unicredit and ING.

Astris Finance acted as exclusive financial advisor to Amarenco.

October 2022 - Astris Finance congratulates Sonnedix on the successful acquisition of ARCO, one of the largest independent renewable power producers in Chile.

Astris Finance congratulates its client Sonnedix on the successful acquisition of 100% of ARCO, one of the largest independent renewable power producers in Chile. Astris acted as exclusive buy-side financial advisor to Sonnedix in the transaction.

Arco is a large solar and wind generation platform in Chile consisting of 290MW of operational capacity and 200+ MW under development, previously owned by Arroyo Investors. The assets are geographically diversified across the country and include both utility scale and small-and-medium sized generation facilities (known in Chile as “PMGDs”). While Sonnedix has been active in the solar PV space in Chile since 2015, the ARCO investment represents Sonnedix’s first foray into the Chilean wind sector. In combination with Sonnedix’s existing assets, the portfolio will grow the company’s local Chilean presence to over 1GW of total capacity, and 7.4 GW globally.

Tobey Collins, Head of Astris Americas, commented “We are delighted to have advised Sonnedix in this landmark purchase in Chile. After several collaborations in Europe, we are particularly happy to celebrate our first successful transaction with Sonnedix in the Americas region."

Astris Finance acted as financial advisor to Sonnedix on the acquisition -- the second successful M&A buyside closing in Latin America for Astris over last year, following advising the Celeo Group on the acquisition of Colbún Transmisión in 2021. This transaction further strengthens Astris position as the leading financial advisor in the Latin American renewable space where we have closed 15 transactions in the past 5 years for an installed capacity in excess of 2GW.

October 2022 – Astris Finance Congratulates Q-Energy for the Successful Debt Closing of EUR 96m for a 113MWp (87 MWac) Solar PV Project Located in Poland

The solar PV plant will be located in Milkowice, Poland, with a total installed capacity of 113MWp (87 MWac). It is the first project that Q-Energy builds in Poland and one of the largest solar PV plants in Poland to date.

The transaction is a pathfinder in the Polish renewable space, with a Euro-denominated PPA and a Euro-denominated financing. The € 96 m term facility was provided by PKO BP as sole lender.

The Project is currently being constructed and completion is expected to be achieved in December 2024. The energy generated by the solar farm will be sold to Amazon under a long-term, corporate power purchase agreement (CPPA). Amazon is the world's largest corporate purchaser of renewable energy and this CPPA will help Amazon on its path to power its operations with 100% renewable energy by 2025, five years ahead of its original target of 2030.

Astris acted as exclusive financial advisor to Q-Energy in the structuring and closing of the transaction. Since 2018, Astris has developed a significant expertise in the Polish renewable energy sector: we have closed 7 debt financing and M&A transactions in this market for an aggregate value of close to € 1 bn, and our teams are currently managing 3 active processes.

October 2022 - Astris advises DIF Capital Partners for the closing of a partnership agreement with the leading global renewable energy platform Qair

Astris Finance congratulates its client DIF Capital Partners (“DIF”), a leading global independent investment manager, for the closing of a partnership agreement whereby DIF will invest in Qair, a fast growing renewable energy platform company, to accelerate its growth and portfolio build out.

The transaction, which closed in September 2022, took the form of a minority investment by DIF, through DIF Infrastructure VII, in the platform owning the assets.

The platform is focused on a wide range of technologies including onshore as well as offshore wind, utility scale solar, energy from waste, hydroelectricity, storage, hydrogen production, as well as tidal energy. The operational portfolio of ca.1 GW is mainly comprised of onshore wind for c. 75% and solar projects, and the development pipeline capacity amounts to up to 25 GW.

Astris acted as exclusive financial advisor to DIF. Astris has a long-standing relationship with DIF, for which it has acted as exclusive advisor on several M&A and senior debt financing transactions over the past few years.

This landmark transaction strengthens Astris’s position in the European renewable sector, where we have executed 12 transactions since January 2022 (out of which 7 in the M&A space) and are currently managing several processes in France, Spain, Italy and Germany.

September 2022 - Astris Finance congratulates its client Equitix for the successful refinancing of the Grünwald geothermal plant in Germany.

Following the acquisition of the Geothermische Kraftwerksgesellschaft Traunreut mbH (“GKT”) from Grünwald Equity in Q1 2022, Equitix has now reached financial close on the refinancing. Astris acted as exclusive financial advisor to Equitix on both processes.

GKT is a geothermal combined heat and power generation facility connected to a district heating network in Bavaria, Southern Germany. The plant was commissioned in 2014 and currently has 42 years of remaining operating life, its primary objective being the production of electricity and heat from thermal brine energy. The facility has an electricity generation capacity of 5.5 Mwel, with an expected yearly production of c. 34 GWh, and a heat generation capacity of 12 MWth, with an expected yearly production of c. 43 GWh. The project will help avoid c. 20kt of CO2 emissions per year.

”We are very pleased we advised Equitix in connection with the refinancing of this combined heat and power geothermal plant in Germany. The transaction shows the attractiveness of refinancings for operational assets benefitting from a strong feed-in-tariff framework.” said Theoharis Saroglou, Director of Astris's Hamburg office.

This is the third successful closing for Astris Germany in 12 months. Currently Astris Germany is advising clients both on the financing of large-scale greenfield projects and on renewable energy M&A processes.

September 2022 – Astris Finance Congratulates its Client Fotowatio Renewable Ventures (FRV) on the Successful Greenfield Financing of a 123MW Solar Portfolio in Spain

September 2022 – We are pleased to announce the closing of the Carmonita Norte Cluster financing in which Astris advised FRV, a leading Spanish developer with a significant footprint in the global renewable space, in connection with the financing of a 123MW solar portfolio composed of 3 green field projects located in Spain.

Once the plants are operational, project revenues will benefit from a long-term PPA. This portfolio is part of a larger set of Solar PV ground-mounted assets, currently at financing stage.

This new financing brings several important benefits for FRV in terms of structure, leverage, and stability of cash flow to shareholders. The transaction was arranged and financed by ING, MUFG and Santander Corporate & Investment Banking which provided the +80M€ senior financing facilities.

Astris Finance acted as exclusive financial advisor to FRV.

September 2022 – Astris Finance acted as exclusive financial advisor to The Blue Circle in connection with its latest capital raise leading to a strategic partnership with ACCIONA Energía.

Astris Finance is very pleased to announce the successful closing of the third round of capital raise of The Blue CIrcle, a leading Singapore-based developer of wind projects in Southeast Asia. The transaction includes a US$34 million equity investment by Acciona Energia in The Blue Circle and a commitment up to US$113.5 million to provide equity for projects that reach ready-to-build status.

The Blue Circle has 84MW of operating wind projects in Vietnam –in which it maintains a 50% voting stake–, and a 1.4GW+ pipeline of projects at an advanced stage of development. The total portfolio under development amounts to 3.8GW spread across Vietnam, Thailand, the Philippines, Cambodia, Indonesia, Laos and Sri Lanka.

Astris Finance acted as exclusive sell-side financial advisor to The Blue Circle with the mandate to raise adequate capital to sustain the platform’s expected growth over the next five years while minimizing the dilutive impact on the controlling shareholder’s stake in The Blue Circle.

Olivier Duguet, CEO and Chairman of The Blue Circle commented: “We mandated Astris Finance with very specific conditions in terms of partner profile, expected valuation and governance structure, not to mention a “not-to-be missed” long-stop date for completion. Astris entirely managed the process leading to this new partnership with Acciona Energia which is fully aligned with our requirements. I am very thankful for Astris’s commitment, creativity and professionalism in executing this transaction in a timely fashion at this pivotal moment of The Blue Circle’s development.”

Hugo Virag, who heads Astris Finance’s operations in Southeast Asia, said: “We thank Olivier Duguet and The Blue Circle’s shareholders for their renewed confidence in Astris Finance’s capacity to help The Blue Circle raise fresh capital since its very first steps in Southeast Asia, beginning with the long-term, non-recourse project financing of its landmark Dam Nai wind farm in Vietnam back in 2017. We are very pleased with the outcome of this intense six-month competitive process leading to the closing of a well-balanced joint-venture between The Blue Circle and Acciona Energia complemented by an innovative, non-dilutive funding structure.”

Fabrice Henry, CEO of Astris Finance, added: “There is no doubt that the Southeast Asian renewables market is poised for a strong acceleration in the next couple of years, with the upcoming Thai wind program, the launch of a new series of auctions in the Philippines, and the advent of an ambitious PDP8 in Vietnam in particular. In this context, we believe that the partnership we helped establish between The Blue Circle, a regional pioneer, and Acciona, a global renewable powerhouse, will play an instrumental role in helping the region reduce its dependency on fossil fuels.”

This is the tenth M&A transaction closed by Astris this year in the global renewable space, and the third in Southeast Asia in the past 12 months.

June 2022 – Astris #1 in the 2021 IJ Global League Table for European Renewable Energy Financial Advisory

Here is a piece of good news, just before the first semester of 2022 ends: we are delighted to report that -- for the first time since its creation over twenty years ago -- Astris reached the top spot in the 2021 IJ Global League Table for European Renewable Energy financial advisory.

This top position rewards an exciting year 2021 for Astris in Europe where we helped bring eighteen transactions to closing in France, Spain, Germany, Poland and Italy. These include a wide array of deals, both on the financing side (development stage advisory, debt and equity raising) with EUR 3bn raised, and on the M&A side (sell-side, buy-side, investor solutions).

Since 2011, Astris has built an unparalleled track record in the European market from its offices in Paris (2011), Madrid (2017) and Hamburg (2020): in the past 5 years, we have closed over 40 M&A transactions for a combined enterprise value of 10+ bn€ and 50 financing transactions with 9+ bn€ of debt raised.

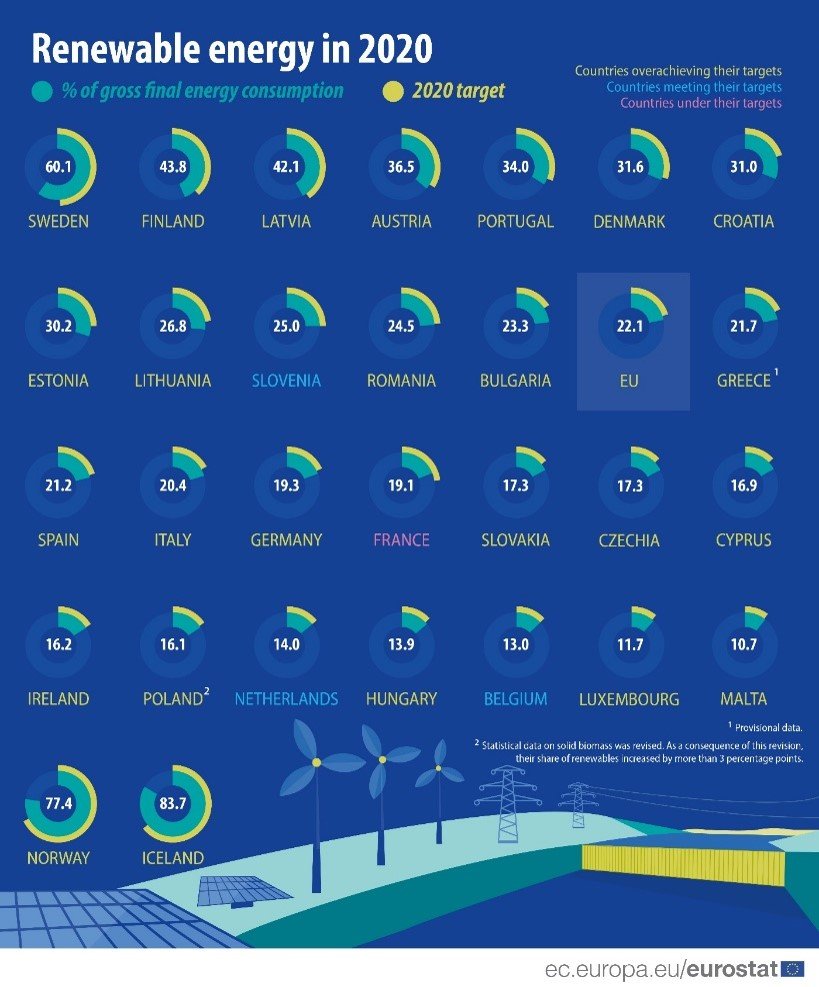

The coming years will be fascinating when it comes to the European renewable energy sector. The “RE Power EU plan” published by the European Commission in May 2022 establishes a three-pronged strategy to drastically reduce Europe’s dependence on Russian fossil fuels: energy savings, acceleration of renewable energy deployment, and diversification of energy sources. Under the second pillar, the Commission increased the target share of gross final energy consumption from renewable sources to 45% by 2030 from just 22% in 2021.

This very ambitious growth will require reaching an aggregate renewable energy generation capacity of 1236 GW by 2030 – an increase of more than 700 GW compared with the installed capacity at the end of 2020. That is fully 100 GW per year! (Source: EU Commission, Eurostat, 2022)

This increased installed capacity will need to come hand in hand with new business models and technologies such as storage, smart grid, peak shaving and demand-side management, EV charging, hydrogen storage, etc. Astris hopes to do its share, however modest, to help achieve this existential challenge!

Thomas Innocenzi, Head of European Operations for Astris said: “As we continue strengthening our position in the European renewable energy space, we would like once again to thank all of our clients and partners for the solid relationships we have established over the years as well as our team for the rigor, creativity and energy deployed on every one of our mandates.”

June 2022 - Astris congratulates its clients for the closing of a USD 475m financing package for the Ferrocarril Central Rail Track PPP Project in Uruguay.

Astris Finance is pleased to announce the closing of a USD 475m financing transaction for the Ferrocarril Central Rail Track PPP Project (the “Project”) sponsored by Sacyr Concesiones, NGE Concessions, Saceem and Berkes (the “Sponsors”).

Following up on Astris’ role as exclusive financial advisor for the USD 860m senior debt package in October 2019 and the USD 75m mezzanine debt in June 2020, Astris advised the Sponsors in (a) structuring and placing a financing package to fund new investments and replace a piece of the initial financing; and (b) extending the maturity and reprofiling part of the existing senior debt (together, the “Refinancing”).

The Project consists of the design, construction, financing, rehabilitation, and maintenance of a 273 km railroad between the cities of Montevideo and Paso de los Toros, Uruguay, under a 19.25-year PPP contract. Construction works are progressing, and COD is expected to take place in H1 2023.

The Refinancing package consists of:

1. The structuring and issuance of a USD 250m private placement subscribed by Allianz GI under a B Bond facility to support the construction of the Project and refinance a portion of the initial financing;

2. The refinancing of USD 175m of IDB and IDB Invest Loans to extend the maturity of existing facilities and match the B Bond repayment profile;

3. The refinancing of a USD 50m B loan provided by Intesa San Paolo.

With this Refinancing, Allianz GI joins the IDB, the IDB Invest, SMBC, Intesa, CAF, CAF-AM and GIP to provide more than USD 1bn of multi-tranche financing to the Project in aggregate.

May 2022 – Astris Finance Congratulates its Client Puerto Bahia Colombia de Uraba (PBCU) on the Successful Closing of a USD 765 Million Port Project in Colombia

Astris Finance is delighted to announce the closing, first disbursment and start of construction for the emblematic Puerto Antioquia project, a US $765 million port complex, for which the first stone was laid on April 23 in Uraba, Colombia. Since 2015, Astris has advised PBCU, the project company, as well as its Sponsors, supporting the entire development of the project, coordinating the contractual and financial equity structuring and raising fully non-recourse senior and mezzanine project financing as well as third party equity.

The Sponsor group includes PiO S.A.S., the initial project developer; CI Uniban, CI Tropical, CI Banafrut, Grupo Santamaria, four of the largest tropical fruit cooperatives in the region, who will be port users; CMA CGM, one of the world's leading shipping lines, who will act as port operator; Groupe Eiffage and Termotecnica Coindustrial, who joined forces to act as EPC contractor; and UPLI, an infrastructure fund managed by SURA and Credicorp.

On the financing front, Astris raised a total of USD 523.7 million of project finance debt made up of two tranches:

US $393.7 million of senior debt from IDB Invest, FDN, Davivienda and Bancoldex; and

US $130.0 million of mezzanine debt from Global Infrastructure Partners.

The project consists of a multipurpose port in the Gulf of Uraba, located in the Department of Antioquia, Colombia. The complex will feature a 38-hectare onshore facility connected to an offshore docking platform by a 3.8-km viaduct. In its first phase of construction, it is designed to accommodate an annual throughput of 660,000 TEUs, 1.5 million tons of dry bulk, 1.1 million tons of general cargo, and 60,000 vehicles.

As the first major greenfield port to be built in the Uraba region, Puerto Antioquia is poised to transform the logistics landscape of northern Colombia and enhance the competitiveness of the Colombian industry. The project will also contribute to the economic and social development of the Uraba region by bringing employment and responsible investment, compliant with the highest environmental and social standards.

Operations are scheduled to start in 2025: when Puerto Antioquia opens for business, it will be the port on the Atlantic closest to a perimeter representing 75% of the country's GDP and connected to the region of Medellin by world-class road infrastructure following the completion of the Mar 1 and Mar 2 4G toll road projects.

Astris Finance is proud to have led the structuring of one of our most exciting and challenging transactions in our 22 years of existence so far. It is an honor to participate in a project that is certain to have a lasting economic and social impact on the beautiful region of Uraba. We are very grateful for the active participation of the most important stakeholders in the region: the local communities around the project, the banana farming cooperatives, the municipal governments of Apartado and Turbo, the department of Antioquia, as well as the various central government line ministries and agencies. We wish the project and its stakeholders a very bright future.

May 2022 - Astris Finance advises on partnership for 400 MW+ ready-to-build solar portfolio in Spain and Italy.

The recent acceleration of government deployment targets for renewable projects in Europe, boosted by the current geopolitical situation of the continent, is leading to an increasing number of transactions whereby local developers syndicate their equity interest in their development portfolio to financial or strategic investors, typically at Ready-to-Build (RtB) stage.

The Spanish market is particularly well suited for this type of partnerships given the strong local hurdles that must be overcome to bring projects to RtB, notably in terms of access to the grid. In this specific transaction, Astris advised the developer in the structuring and placement of an efficient co-investment by a financial investor to recycle the client’s development equity investment in a 400+ MW pipeline located in Spain and Italy -- allowing our client to accelerate the growth of their development pipeline.

Gonzalo Ruiz de Angulo, Head of Astris Finance for Spain, Portugal and Poland, said: “We are very pleased we were able to structure the right partnership and source the right partner for our client. The partner brings competitive long-term capital and in exchange gets access to a quality pipeline of RtB projects. This transaction confirms that the RtB stage is a nice meeting point for developers and investors in terms of risk-return combination in the Southern Europe renewable sector.”

Astris Finance acted as exclusive sell-side financial advisor on the transaction. This is the seventh European renewable partnership on which Astris advised on the sell side in the past 24 months.

April 2022 - Astris voted LatAm Financial Advisor of the Year by IJ Global - for the 5th time in a row! - and Proximo Infra

This is now the fifth time in a row and the sixth time in seven years that Astris Finance has received the Latin America’s Financial Advisor of the Year award.

Astris's 2021 achievements:

26 deals closed across Europe, the Americas and Southeast Asia

$ 5.6bn of debt raised

Latin America Financial Advisor of the Year Award by both IJ Global (for the 6th time in 7 years!) and Proximo Infra (for its inaugural award)

Deal of the Year Awards: Puerto Antioquia (Sponsors: Colombia Banana Industry Stakeholders/CMA-CGM/Eiffage) by IJ Global and Alfa Desarollo (Sponsors: Celeo/APG) by PFI Magazine

From left to right: Romain Papassian (Head of Infra for the Americas), Tobey Collins (Head of Energy for the Americas), and Juan Francisco Toro (Head of infra for Latin America), receive the Proximo Latin American Advisor of the Year award.

New York, 9 March 2022

Washington DC, 1 April 2022

Dear friends,

It is this time of the year again – and I am very pleased to report that Astris Finance has been named 2021 Financial Advisor of the Year for Latin America by both IJ Global and Proximo Infra.

Our landmark Puerto Antioquia project in Colombia also won the IJ Global Latin America Transport Deal of the Year award. This $792 m greenfield container port project -- on which we have been working for over seven years -- is expected to drastically cut the CO2 footprint and improve the economic efficiency of international trade from and to the north of Colombia. More later on this fascinating project.

These awards cap an exciting year 2021 for Astris in Latin America. Beyond Puerto Antioquia, we have helped take six projects to financial close in Colombia, Mexico, Chile, Brazil and Peru, adding up to USD 2.3 bn of debt raised. In particular, Astris advised Dutch pension fund APG and Spanish developer Celeo on the c. USD 1.2 bn acquisition and financing of the Colbun transmission line portfolio in Chile, through an innovative 30-year project bond.

This is the sixth time in seven years that Astris Finance has been named IJ Global Financial Advisor of the Year for Latin America. As we continue strengthening our position in the Latin American infrastructure and energy space, I would like once again to thank all our clients and partners for the fantastic relationships we have established over the years -- and I want to thank our team for the rigor, the creativity and the energy they deploy on every one of our mandates.

Kind regards,

Fabrice Henry

Chief Executive Officer

March 2022 – Astris Finance Congratulates its Clients Prosolia Energy and Omnes Capital for the Successful Debt Closing of a 63MW Solar Portfolio of Projects located in Spain and Portugal.

The three solar PV plants are located in Spain and Portugal with total installed capacity of 63MW, adding a significant number of megawatts to Prosolia’s 200MW portfolio. These projects are a first step within a strategic agreement between Prosolia Energy and Omnes Capital for the development, construction, and operation of a portfolio of utility-scale solar projects of more than 2GW in Europe. The senior debt facilities were provided by Sabadell.

The Spanish project has secured a 12-year tariff through a government-sponsored renewable auction, while the two Portuguese projects will benefit from merchant revenues only. The projects are expected to reach COD during the course of Q1 2023.

Astris acted as exclusive advisor to Prosolia Energy and Omnes Capital on the senior debt raising for this first batch of projects currently being developed by Prosolia Energy. Since 2017, Astris has developed a deep expertise in the Iberian renewable energy sector and has closed over 10 financing and M&A mandates.

March 2022 – Astris Finance Congratulates its Clients Valeco, Mirova and GEG for the Successful Refinancing of a 220MW Wind and Solar Portfolio

We are pleased to announce the closing of the “Lily” project in which we assisted Valeco, a French leading developer, fully owned by the German utility EnBW, Mirova, a French leading asset manager with a significant footprint in the European renewable space, and GEG, a local French developer and electricity provider, in the EUR 300m refinancing of a 220MW wind and solar portfolio composed of 13 projects located in France and benefiting from 15-20y CfDs with EDF.

Project Lily consisted in the refinancing of three sub-portfolios which have been structured based on the existing ownership of the projects, for a total debt amount of EUR 300m. The new financing brings several important benefits for the sponsors: a maturity extension, a lower debt service coverage ratio, the replacement of the existing DSRAs by an unfunded DSRF, the implementation of an optimized and flexible financing structure and a significant reduction in financing costs. The transaction was arranged and financed by Crédit Agricole Group, Caisse d’Epargne CEPAC and BPI.

Astris Finance acted as exclusive financial advisor to Valeco, Mirova and GEG.

February 2022 - Astris Finance congratulates its client Equitix for the successful acquisition of the Grünwald geothermal plant in Germany.

Astris advised Equitix on the acquisition of 100% of the shares in Grünwald Equity Geothermie GmbH (“GET”). The plant was sold by Grünwald Equity. Astris Finance acted as buy-side financial advisor to Equitix.

GET is a geothermal combined heat and power generation facility connected to a district heating network in Bavaria, Southern Germany. The plant was commissioned in 2014 and currently has 42 years of remaining operating life, its primary objective being the production of electricity and heat from thermal brine energy. The generation facility has an electricity generation capacity of 5.5 Mwel, with an expected yearly production of c. 34 GWh, and a heat generation capacity of 12 MWth, with an expected yearly production of c. 43 GWh. The project will help avoid c. 20kt of CO2 emissions per year.

”We are very pleased we advised Equitix in connection with the acquisition of this combined heat and power geothermal plant in Germany. The transaction shows the attractiveness of the German market and underpins once again that international investors are keen to invest in operational assets which benefit from a strong feed-in-tariff framework.” said Theoharis Saroglou, Director of Astris's Hamburg office.

This is the second successful closing for Astris Germany in six months, following the Q4-2021 closing of the sale of a wind portfolio managed by German asset manager KGAL to Italian renewable IPP ERG, for which Astris acted as sell side advisor to KGAL.

November 2021 – Astris Congratulates its Client Marguerite for the Successful Acquisition of an Equity Participation in ZE Energy

We are pleased to announce the closing of Project Zeus, for which Astris advised Marguerite, a leading European investment fund. The transaction consisted in the acquisition of an equity stake in French company ZE Energy through a capital increase. Astris acted as exclusive financial advisor to Marguerite.

ZE Energy was founded in 2019 by an experienced management team of former Solairedirect and Engie employees. It is an integrated solar-plus-storage developer whose business model relies on a combination of solar PV, battery and aggregation activities. Its main markets are France, Spain, the UK, Italy and Germany. Through this capital increase, Marguerite will own a significant stake in ZE Energy, alongside existing investors.

This landmark transaction further strengthens our relationship with Marguerite, whom we advised two years ago for the sale of their French solar portfolio. It will also undoubtedly pave the way for additional work in the fast-growing storage sector.

November 2021 - Astris Finance congratulates its client Urbasolar for the sale of two French greenfield solar portfolios representing c. 400MW

November 2021 - Astris Finance congratulates its client Urbasolar, one of the largest vertically integrated solar power producers in France, 100% owned by Axpo (the largest Swiss producer of electricity from renewable sources) for the signing of the Cassiopée Transaction, which consisted of the sale of a participation in two French greenfield solar portfolios with an aggregate capacity of c. 400MW to Predica (Crédit Agricole Assurances), a leading French insurance company. Astris acted as exclusive financial advisor to Urbasolar.

The acquisition, made by a dedicated vehicle named PredUrba, is the first milestone of an ambitious partnership agreed between the two parties, in which Predica will have the opportunity to acquire up to 2.4GW of solar assets located in France and potentially other European countries in the next 3 years.

"Since the beginning of 2020, it is the fifth partnership between a renewable energy developer and a financial investor which Astris has successfully arranged. This trend illustrates the growing interest of the market for these partnerships, which are a clear win-win proposition: they allow the developer to finance its growth by accessing equity at a competitive cost from an experienced investor, and they allow the investor to deploy liquidity by accessing a diversified pool of low risk renewable projects from an experienced developer," says Arnaud Germain, Head of Astris France & Germany.

October 2021 - Astris Finance congratulates its client KGAL for the sale of a wind and solar power portfolio with an installed capacity of 152.4 MW in Germany and France

The wind and solar portfolio, managed by KGAL on behalf of a German pension fund through a separately managed account, has been acquired by ERG, the leading Italian listed IPP, through its subsidiaries ERG Eolienne France SAS and ERG Windpark Beteiligungs GmbH.

It comprises 15 SPVs, seven photovoltaic and three wind farms with an installed capacity of 56.7 and 40.6 MW respectively located in France; and five wind farms with an installed capacity of 55.1 MW located in Germany.

The projects were commissioned between 2012 and 2017 and benefit from a feed-in-tariff with an average expiry date of 2032. The estimated total annual production of 273 GWh equals approximately to 2,100 equivalent hours for wind assets and 1,300 equivalent hours for photovoltaic assets, which amounts to 150 kt of avoided CO2 emissions per year.

“Asset divestment is becoming an increasingly important part of KGAL's investment strategy as we focus on an active buy-build-sell approach in our current funds.“ says Michael Ebner, Managing Director of Infrastructure at KGAL Investment Management. “With an experienced advisor like Astris Finance, we can achieve the best possible results for our investors in the transactions.“

”We are very pleased we advised KGAL in connection with the disposal of a scarce and sizeable renewable energy portfolio in Germany and France and to have successfully closed our first mandate in Germany since the opening of our Hamburg office in March 2021.” said Theoharis Saroglou, Director of Astris's Hamburg office. "The transaction shows the attractiveness of the German and French markets and underpins once again that international investors are keen to invest in operational assets which benefit from a strong feed-in-tariff.” added Arnaud Germain, Head of Astris Finance France and Germany.

Astris Finance acted as exclusive sell-side financial advisor to KGAL and involved Astris teams both in Hamburg and Paris.

September 2021 - Astris Finance advises APG and Celeo on the c. $1.2 B acquisition and financing of Colbún Transmisión in Chile.

September 2021 - Astris Finance congratulates its clients APG and Celeo on the strategic acquisition of Colbún Transmisión in Chile through their affiliate Alfa Desarollo. With this acquisition, APG and Celeo jointly have the third largest transmission portfolio in Chile by line length. The acquisition from Colbun SA was completed on September 30, 2021 for a price of US$1,172 M after the settlement of the acquisition financing on September 20, 2021.

Astris served as exclusive financial advisor to APG and Celeo during the competitive acquisition process which started in the fourth quarter of 2020 and culminated in the execution of a share purchase agreement with Colbun on March 30, 2021. Working closely with the legal and other advisors to APG and Celeo, Astris assisted in all aspects of the due diligence and negotiation of the acquisition as well as the financing process.

As part of the financing process, Astris worked to obtain investment grade shadow ratings for Alfa Desarollo as well as a fully committed bridge loan from JP Morgan which was ultimately not drawn. The financing was structured as a project bond in the amount of $1,098 M, rated BBB- by Standard & Poor’s and Baa3 by Moodys which was settled into escrow prior to the acquisition date. The bond which has a 30-year final maturity and a 24-year average life was more than four times oversubscribed at its peak. JP Morgan acted as Global Coordinator and Citibank, Santander and SMBC also served as Joint Bookrunners. The Joint Bookrunners also provided a letter of credit facility recourse to Alfa Desarollo which was structured by Astris as part of the acquisition financing package.

“Astris Finance is honored to have been selected to advise this strong sponsor group in such a competitive process. We are thrilled for APG and Celeo to close this landmark transaction in Chile under such attractive conditions,” commented Tobey Collins, Astris’ Head of Energy for the Americas. Angel Ortega, Celeo´s Chief Investment Officer, said “We are very pleased to expand our presence in Chile with this strategic acquisition and to close our third successful transaction with Astris Finance in Chile in the last five years.”